How does the old saying go? “The only things that are certain are death and taxes.” Another favorite quote of mine is “I am happy to pay my taxes. However, I would be just as happy at half the rate!” When it comes to taxes we all complain. People and businesses alike are fleeing cities and states such as New York and California to states with lower tax rates. However, when it comes to firearms and ammunition, the excise taxes you pay are a bit easier to swallow when you know how the money is spent.

Each year, firearm and ammunition manufacturers pay millions of dollars in excise taxes into the Wildlife and Sport Fish Restoration (WSFR) program that result in long-term benefits to industry, target shooters, and hunters. A new study, announced by the National Shooting Sports Foundation (NSSF), reveals how these payments—some $792 million in 2020 alone—provide not only bedrock funding for the enjoyment of the shooting sports but also a major return on investment for industry.

When it comes to firearms and ammunition, the excise taxes you pay are a bit easier to swallow when you know how the money is spent.

With support from a grant awarded by the Association of Fish and Wildlife Agencies’ (AFWA) Multistate Conservation Grant program, a new report titled “Benefits & ROI of Wildlife & Sport Fish Restoration Funds” highlights for industry leaders the financial returns their businesses receive from investing in the WSFR program.

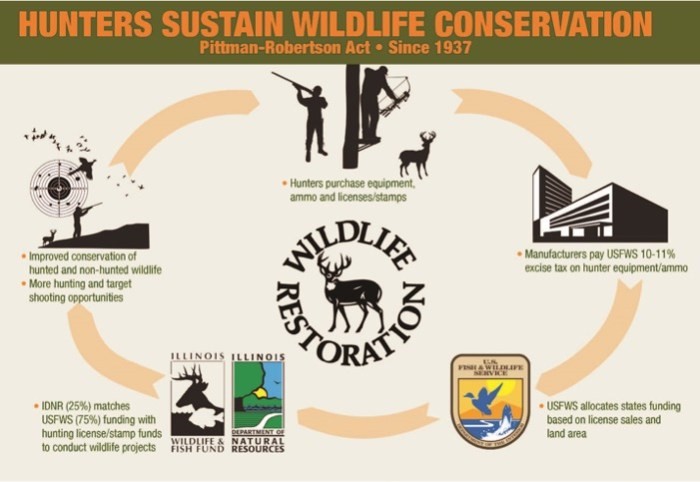

WSFR is funded by a 10-11 percent tax on firearms, ammunition and archery equipment paid by the manufacturers, along with similar excise taxes on fishing and boating equipment. These funds are distributed by the U.S. Fish and Wildlife Service to its state agency counterparts to invest in conservation and recreational access programs that benefit hunters, target shooters, anglers, and boaters. The history of excise taxes on shooting sports equipment dates to 1937 when the Pittman-Robertson Wildlife Restoration Act Infographic, establishing a model of conservation funding that eventually would lead to significant expansion of hunting and shooting opportunities nationally.

“Manufacturers and other businesses frequently ask about the importance and effectiveness of the excise tax program. The findings of this study clearly show that decades of sound investment, wildlife management and conservation, and increased recreational access have significantly helped the shooting sports industry grow to where it is today. The excise tax program is an investment in the continued growth of our industry,” said NSSF President and CEO Joe Bartozzi.

Produced by Southwick Associates, the report provides multiple examples of how the excise tax program benefits industry. Two specific examples include:

- The public shooting range located within Oklahoma’s Lexington Wildlife Management Area—about an hour south of Oklahoma City—offers thousands of visitors opportunities to enjoy target shooting. The total estimated spending by target shooters at the Lexington Wildlife Management Area on excise tax-related items is an estimated $1.7 million annually. With annual excise tax investments for range improvements averaging $307,000. The industry is receiving a 358 percent return!

- When North Carolina’s turkey season re-opened in 1977, only 144 birds were harvested. By 2018, over 17,000 turkey were being harvested annually. This is just one of many success stories across the country about the restoration of populations of game species.

Industry investments in WSFR lead to a leveraged cycle of benefits, with investments made in one year often generating benefits for many years to come. In addition, the federal Pittman-Robertson legislation prohibits states from diverting hunting and fishing license dollars away from their fish and wildlife agencies as a condition of benefitting from P-R funds, further protecting sportsmen’s dollars. As a bonus, every three excise tax dollars must be matched at least by a dollar from a non-federal source, further strengthening the value of the tax dollars paid into the program.

“The important thing for industry leaders to know is that their excise tax payments provide real, lasting benefits for the industry, funding more and more hunting and recreational shooting opportunities which translate into greater sales,” noted Bartozzi.

The report’s new excise tax insights are available from www.nssf.org/research/wildlife-restoration-program/. Visit this site to learn more about the excise tax, how the funds are spent and about the results generated for businesses who pay the tax. Included is an interactive map providing “Then and Now” statistics for each state.

We all hate taxes. However, as perhaps the least painful of the bunch, how do you feel about the excise taxes paid by hunters, shooters, and fishermen?

Cocked and Locked is the official content provider of TheBestShootingSite.com. Be sure to also check out: The Microstamping Myth Revealed